1. U.S. Economy

Even as restrictions are being loosened in all 50 states (not including the District of Columbia), the American economy continues to undergo unprecedented trauma. Almost a quarter of the American labor force (36 million people) have filed for unemployment benefits in the last two months. Retail sales declined massively in April (16.4 percent from March, exceeding projections). Retail sales accounts for half of all consumer spending, which in turn accounts for 70 percent of the U.S. economy. The chief economic advisor at Allianz called it the “worst retail sale collapse on record.” Germany’s Chamber of Commerce reported that the collapse in demand for German imports in the United States (Germany’s biggest customer) is much more dramatic than in other countries, “in part because the social safety net is relatively weak.”

Federal Reserve Chair Jerome Powell said last week that the recession was “without modern precedent” and threatens lasting damage to the American economy — a remark credited for pushing markets down. The Federal Reserve released a study last week confirming that 20 percent of American adults have lost their jobs — and in particular those at the lower end of the economic spectrum (39 percent of those earning less than $40,000 annually). Powell offered a more optimistic view on Sunday, saying that he is “highly confident” that the U.S. economy will ultimately make a full recovery, and that the Fed is “not out of ammunition by a long shot.”

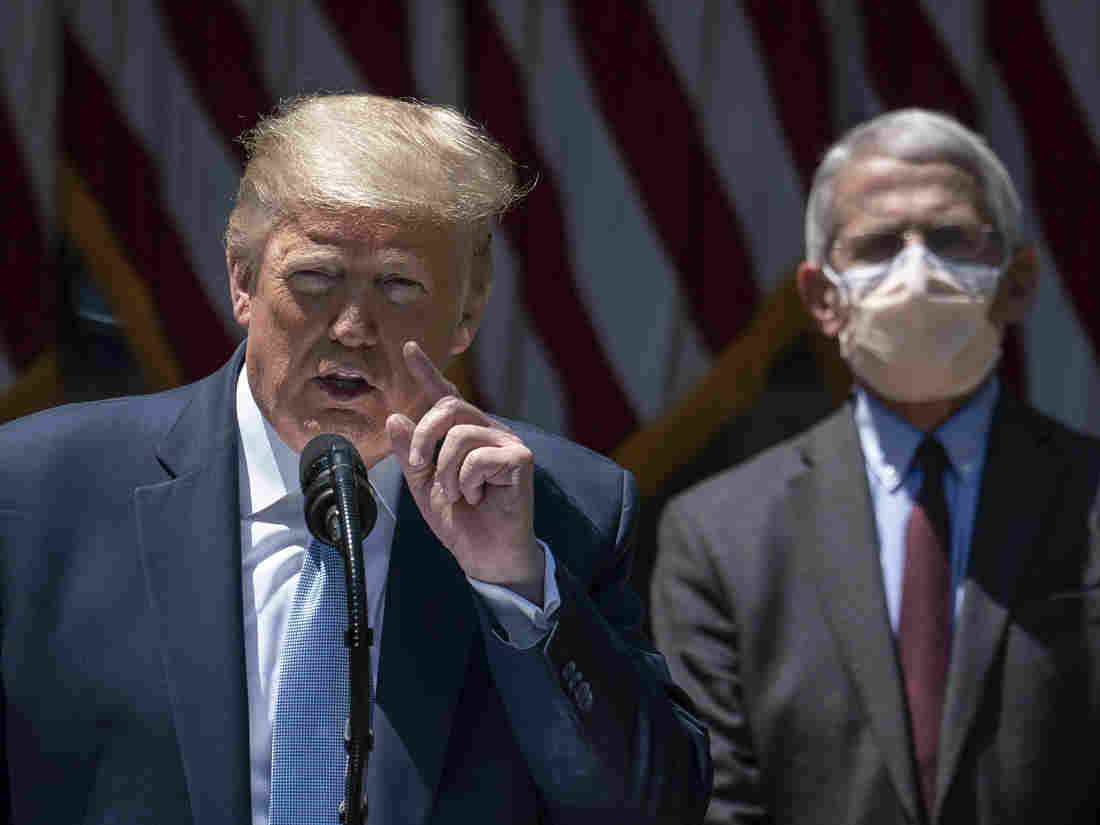

2. Trump Administration Unveils “America First” Vaccine Strategy

The White House has formally launched its strategy to develop a vaccine for COVID-19 (called “Operation Warp Speed”). The initiative’s goal is to finance the development of numerous vaccine candidates, and produce hundreds of million doses by the end of the year. The effort will be led by an Army General (Gen. Gustave F. Perna) and a scientist (Moncef Slaoui, former Chair of GSK vaccines). At the rollout last Friday, Dr. Slaoui expressed confidence in the effort’s likelihood of success. Dr. Fauci also testified last week that a vaccine is “more likely than not,” but did not commit to a timetable.

One of the most promising vaccine candidates belongs to Moderna, Inc., which announced positive data on Monday in connection with its Phase 1 trial. The resulting market rally (and subsequent drop after Stat published a critique of Moderna’s release) demonstrate how eager the markets are for positive news. Nonetheless, the U.S. Food and Drug Administration (FDA) has now granted priority review to Moderna’s vaccine candidate, meaning that the FDA will decide within six months whether the vaccine is safe and effective. The FDA has also now approved the first antigen test for Covid-19 — a type of test that delivers results very rapidly but with less accuracy than other tests.

Operation Warp Speed contemplates limited international cooperation — not surprisingly, from China in particular. This has elicited criticism as an “America First” approach to developing a lifesaving vaccine that ultimately will need to be distributed globally. By way of comparison, the European Union has launched a global effort that brings together partner countries and private actors such as the Bill and Melinda Gates Foundation. (Many other efforts exist as well — for example in the United Kingdom). Separately, President Trump has also now informed the World Health Organization that the United States will reconsider its membership in the organization, absent significant steps toward reform within 30 days.

3. COVID-19 Accelerates U.S.-China Decoupling on All Fronts

The pandemic is accelerating the economic decoupling of the United States and China. Key actors within the Trump Administration (e.g. U.S. Trade Representative Robert Lighthizer, and Undersecretary of State Keith Krach) have explicitly pointed to Covid-19 as a catalyst for an ongoing effort to “reshore” manufacturing jobs to the United States.

In an unusual move, the Trump Administration has tasked an American international development agency to help resupply the strategic national stockpile of pandemic-related supplies, and specifically by “reshoring domestic production.” The U.S. International Development Finance Corporation (created by Congress last year), will lend $1 billion to companies to replenish the national stockpile with a 90-day supply of equipment (300 million N95 masks, 67 million medical gowns, as well as drugs and testing supplies). The head of the DFC Adam Boehler was formerly a health-care industry executive and has close ties to White House advisor Jared Kushner. The Trump Administration has also signed a contract with Phlow Corp. to shift some manufacturing of pharmaceutical ingredients to the United States.

The Trump Administration built another layer of the new digital iron curtain last week: the U.S. Department of Commerce signaled that its export ban prohibiting companies inside the United States from shipping products to Huawei will likely finally go into effect on August 13. Further, Commerce expanded the ban to include not only U.S.-based manufacturers but also foreign producers that use American technology and software in the manufacturing process. Under the expanded export ban, any exporter worldwide that wishes to ship items to Huawei that are a “direct product” of American technology and software will need a U.S. export license. Impacted companies (e.g. Taiwan Semiconductor Manufacturing Co., which announced it has stopped accepting orders from Huawei) are entitled to send comments to the Department of Commerce until July 14, and the ban will go into effect in mid-September.

It should be noted that ultimately, supply chains represent vast numbers of contracts and other private decisions, and can reordered — if at all — only through great effort and time. Sen. Thom Tillis (R-North Carolina), formerly a supply-chain professional and an ally of President Trump, agreed last week that international supply chains will continue to shift away from China, but that it will take years, and “not happen quickly.” Many shifts will continue to occur away from China, but toward Vietnam, India, and other third countries. In addition, many goods that U.S. companies produce in China are intended for the local consumer market and therefore will be especially resistant to reshoring efforts.

The Trump Administration has also persuaded the Thrift Savings Plan (a pension fund for U.S. government employees with $600 billion in assets) to delay a planned investment of $4.5 billion into Chinese stocks. The White House lobbied heavily against the transaction, with support from both Republicans and Democrats in Congress. The Nasdaq is planning to release new rules to make it harder for Chinese firms to list on that exchange. Sen. John Kennedy (R-Louisiana) has introduced a bill to impose tougher standards on Chinese firms that list on American stock exchanges. Sen. Lindsey Graham (R-South Carolina) and other prominent Republicans in Congress are drafting a bill designed to force China to provide a credible accounting of the origins of the pandemic, to close all “wet markets,” and release pro-democracy advocates in Hong Kong.

Importantly, despite widespread efforts to decouple the U.S. and China, the Trump Administration does not support the efforts in Congress to withdraw from the WTO, insisting on a reform agenda instead. The committees in Congress with primary responsibility for trade policy also do not support withdrawal from the WTO. The House Ways and Means Committee, for example, passed a bill in December providing that “the United States should continue to lead reform efforts” rather than withdrawing altogether. For this reason, we don’t believe that the efforts of Sen. Josh Hawley (R-Missouri) and Rep. Peter DeFazio (D-Oregon) to withdraw from the WTO will succeed. In a surprise, the WTO director general has also announced that he will resign early (on August 31), presenting another immediate challenge to the multilateral system.

4. Could China Decoupling Accelerate a New Transatlantic Alignment?

In recruiting international partners in its efforts against China, the Trump Administration has begun to describe the desired international alignments in terms of an economic prosperity network, which would “unite countries, companies, and civil society groups” around a “framework of common standards of operations across a variety of industries.” Even as most international meetings occur virtually right now, U.S. Secretary of State Mike Pompeo personally visited Israel last week, in part to push Israel to decouple from China.

As the world organizes its recovery from the pandemic, Germany and Europe will continue to feel a pull toward one of the poles of the new cold war between the U.S. and China, and there is certainly strong bipartisan sentiment in Washington that Europe should choose the United States over China. Two prominent former Trump Administration officials wrote earlier this month that in its effort to contain China, the “U.S. should align with countries that share its interests in Asia, Europe, and beyond.” The Heritage Foundation has published a “U.S.-European Economic Partnership Recovery Plan.” This may become harder to imagine, however, as German public opinion — at least for now — has shifted away from the United States and toward China. Still, some prominent German voices like Matthias Döpfner assert unambiguously that Europe should align with the United States. One American academic is even encouraging Germany to “become a great power again.”

European Commissioner Phil Hogan is also seeking to recast the current trade talks with the United States as a “transatlantic agenda for recovery,” which would include resolving the dispute over aircraft subsidies (to focus on competing against China), resolving outstanding issues over tariffs, as well as establishing joint reserves of medical equipment for current and future pandemic response.